Step 1- Application Forms

Each tenant must complete the online application form. These are due immediately.

This can be found on our website (Click Here) and can be done on your mobile/laptop.

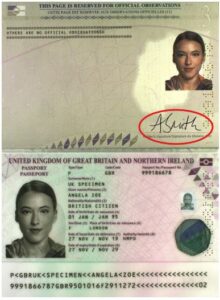

Please read the information on the application and ensure that you fill this in correctly. Include your full, legal name. Make sure that the contact details are correct and let us know if these change at any time.